Meet the world at Breakbulk Europe for new project cargo business

We're counting down the days until 16-18 June 2026 where we'll once again be uniting the project cargo and breakbulk industry.

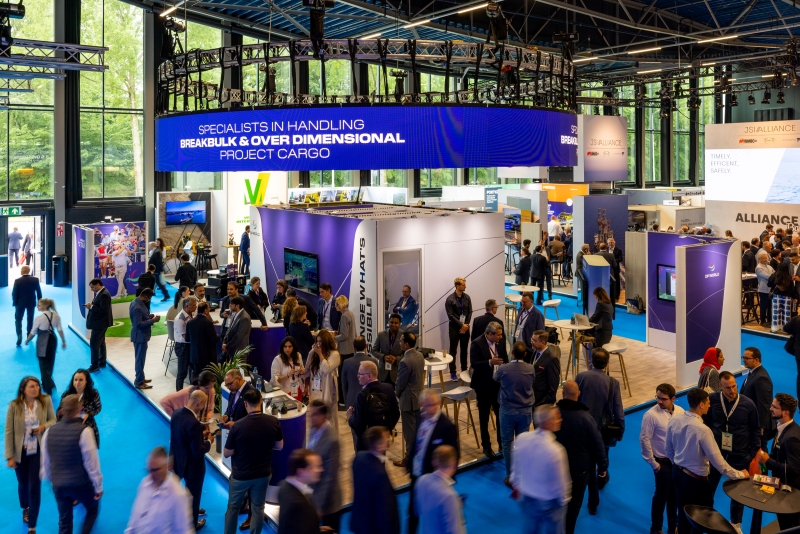

Bringing together over 11,400 attendees, Breakbulk Europe provides the ultimate networking platform to grow your connections, generate new business and strengthen key existing relationships. Join the industry decision makers in Rotterdam to drive the connections and innovation that support the completion of global projects.

Showcase your company

Put your company in front of thousands of key decision-makers from across the project cargo and breakbulk industry.

EXPLORE EXHIBITING

Build connections that last

Network with over 11,400 industry professionals from more than 120 countries and build long lasting business relationships.

EXPLORE VISITING

Increase brand awareness

Position your company as an industry leader and create a long lasting impression in the minds of exhibitors and visitors.

EXPLORE SPONSORSHIP

2025 Stats Brochure

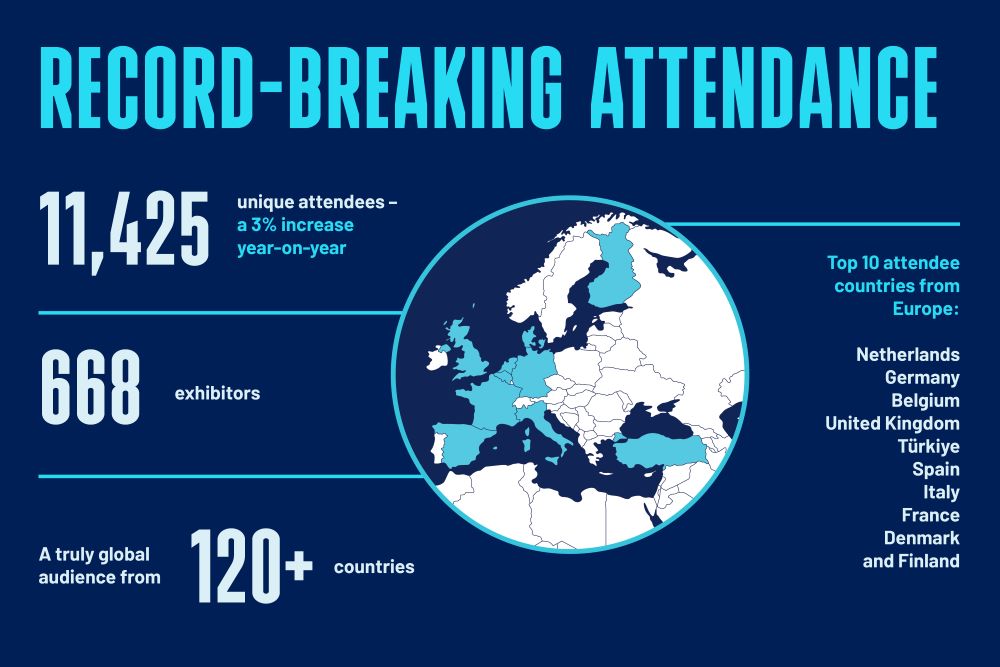

Breakbulk Europe celebrated its 20th anniversary with record-breaking success - welcoming over 11,400 attendees, 577 global shippers, and 668 exhibitors. Industry professionals from 121 countries joined us in Rotterdam, with nearly 50% of all participants coming from the Netherlands, Germany, Belgium, and the United Kingdom. To celebrate this milestone edition, we introduced new initiatives, extended opening hours, and created even more opportunities for meaningful connections and business growth.

Discover the full impact and explore key insights in our 2025 Stats Brochure.

Discover the Breakbulk Europe 2025 Event Highlights

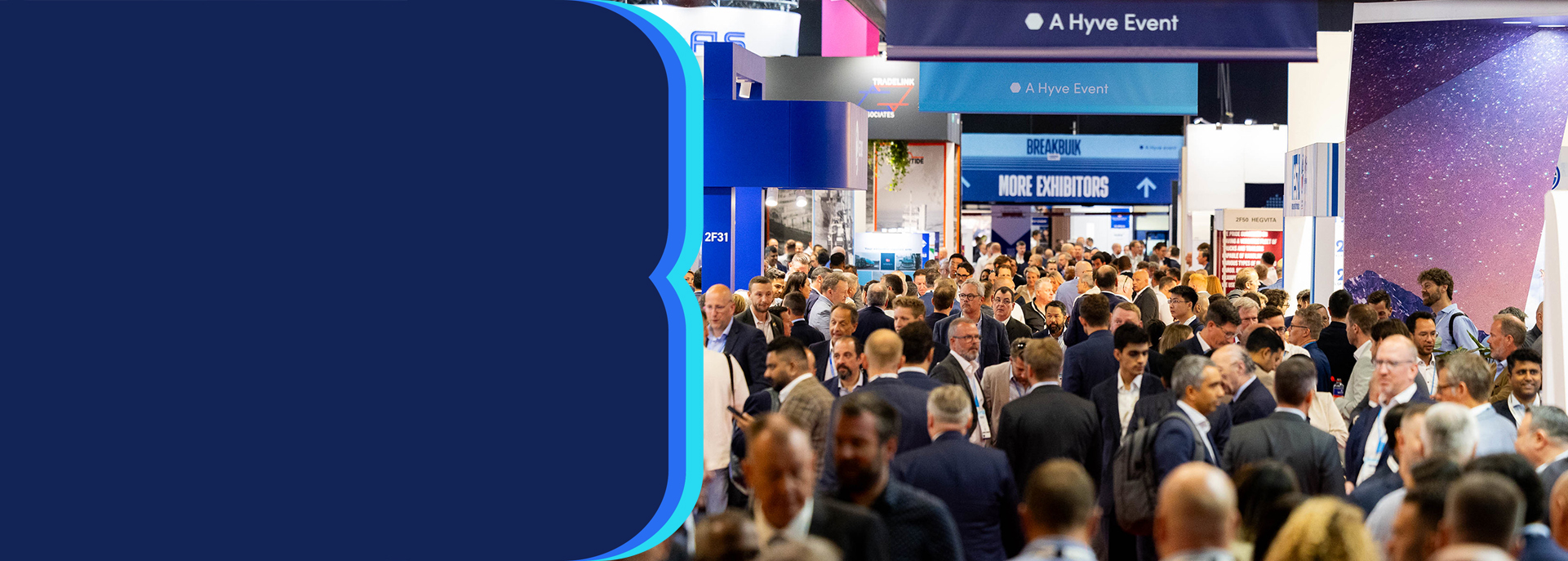

Breakbulk Europe is bigger than ever, and this year marked a special milestone—20 years of bringing the project cargo and breakbulk community together! To celebrate, we’re creating an unforgettable experience that goes beyond business.

Whether you're looking to expand your knowledge, gain insights from industry leaders, reconnect with peers, celebrate achievements, or simply enjoy the lively atmosphere on the boulevard, there’s something for everyone.

Why Freight Forwarders attend

Bringing together thousands of industry professionals, Breakbulk Europe is built for freight forwarders ready to grow. Connect with shippers and carriers, explore new routes and tech, and stay ahead in heavy-lift and oversized cargo. This is where global logistics moves forward.

Learn more

Why Maritime Professionals Attend

From ocean carriers and terminal operators to shippers, EPCs, and freight forwarders, the full maritime logistics ecosystem meets here to exchange ideas, forge partnerships, and drive projects forward.

Learn more

Why Ports and Terminals attend

With leaders from over 120 countries under one roof, this is your chance to showcase your capabilities in handling heavy-lift and complex cargo, connect directly with key shippers, freight forwarders, and carriers, and gain valuable insights into the latest regulations, trends, and innovations shaping maritime logistics.

Learn more

Join us at Breakbulk Europe 2026

Don’t miss your chance to be part of Breakbulk Europe —the world’s largest project cargo and breakbulk event! Register your interest and be first to hear when registration opens.

Industry Insights

Singapore Sets Stage for Breakbulk Asia 2026

Crew Shortages Pose “Biggest Threat” to Carriers

Fleet Renewal and Flexibility Remain Key for Carriers

Winners of the Green World Awards Revealed

Navigating Geopolitical Disruption in Global Trade

Breakbulk Asia Launches in Singapore

Evolving Expectations in Project Logistics

Join the Breakbulk Community

Breakbulk Global Shipper Network

The Global Shipper Network is an exclusive network of senior breakbulk and project cargo owning shippers involved in the engineering, manufacturing and production of industrial projects and project cargo. Access exclusive learning and networking opportunities and join today!

Join the Global Shipper Network

Global Event Partners

If you do business in more than one region in the world, your marketing program should reflect your coverage. The Global Event Partner program is designed to support your business goals through our three events in Dubai, Rotterdam and Houston. Become a Global Event Partner to maximise your reach to key decision-makers.

Become a global event partner

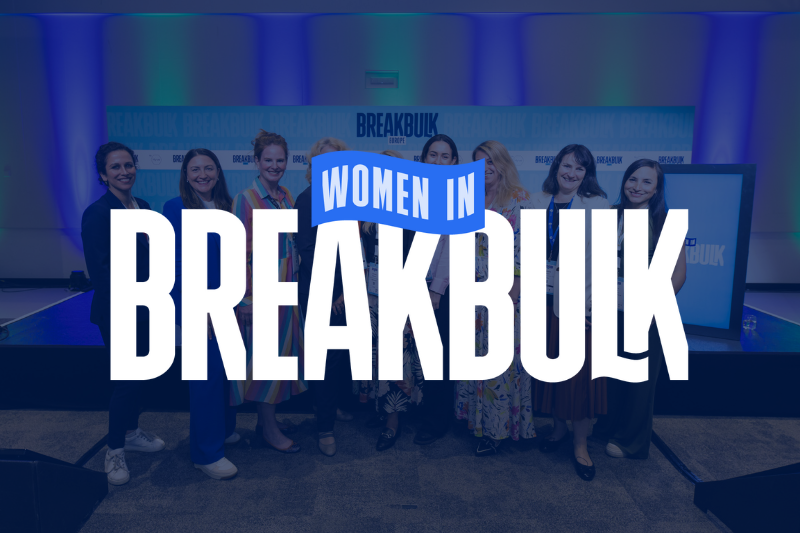

Women in Breakbulk

Become a member of the Women in Breakbulk networking group to stay in contact with other members all year round. Fill out the form and be sure to include your photo and advice to other women. All members receive free entry to the Women in Breakbulk Lounge at Breakbulk Europe and early access to tickets.

Join the CommunityFAQs

Wednesday 17 June: 10:00 – 18:00

Thursday 18 June: 10:00 – 16:00

Download the official Breakbulk App from the Apple App Store or Google Play Store. For full details on how to use the app to maximise your experience at the event - including networking, agenda planning, and exhibitor navigation.

The Breakbulk portfolio of events

.png)

Join us in Houston 22-24 September 2026 at the largest event for the breakbulk & project cargo market in the Americas.

Join us in Dubai on 2-3 February 2027 at the region's project cargo and breakbulk event.

Join us in Singapore 18-19 November 2026 for Breakbulk Asia where major project contracts take shape, new partnerships form, and business gets done.

.jpg?ext=.jpg)

.jpg?ext=.jpg)

_5.jpg?ext=.jpg)

_2.jpg?ext=.jpg)

.jpg?ext=.jpg)

_1.jpg?ext=.jpg)

.jpg?ext=.jpg)

_1.jpg?ext=.jpg)

_1.jpg?ext=.jpg)

.png?ext=.png)

.png?ext=.png)

.png?ext=.png)